If you look around a crowded coffee shop, a busy subway car, or an office waiting room anywhere on Earth, the odds are overwhelmingly high that the majority of people you see are swiping on an Android screen. While the tech world often buzzes loudly about the latest iPhone release, the silent majority of the world runs on the green robot. As we settle into 2026, the data paints a fascinating picture of a mobile landscape that is both deeply divided by geography and united by Google’s open-source platform. Android isn’t just an operating system; it is the primary way the human race connects to the internet, managing the digital lives of billions.

Understanding the sheer scale of Android’s reach requires looking past the localized trends of markets like the United States. Globally, the platform continues to act as the great equalizer of technology, offering accessible entry points to the internet for developing nations while simultaneously powering high-end foldables and flagship devices in wealthy economies. With a user base that has grown consistently for over a decade, Android’s influence in 2026 remains unchallenged on a global scale. This deep dive into the usage statistics of 2026 reveals not just numbers, but the story of how the world communicates, plays, and works today.

This dominance speaks to the fundamental strategy of the Android ecosystem: choice. Unlike Apple’s walled garden, which relies on a single manufacturer selling premium hardware, Android is the engine under the hood for hundreds of different brands. From budget-friendly devices costing under $100 to luxury foldables costing over $2,000, Android is everywhere. This accessibility ensures that as the global population continues to come online, they are overwhelmingly doing so on Android devices. While iOS has made gains in specific premium segments, the raw volume of Android devices shipped annually keeps the platform secure in its throne.

The Great Geographical Divide: Where Android Reigns Supreme

One of the most compelling narratives in the 2026 statistics is the sharp divide in regional preferences. If you live in North America, your perception of “standard” might be skewed. In the United States, the script flips completely. Here, Android holds about 41.71% of the market compared to iOS’s lead. The narrative is similar in Canada, where iOS leads with roughly 60% of the market. In these wealthy Western markets, the ecosystem lock-in of iMessage and FaceTime, combined with high disposable income, keeps Apple competitive.

However, step outside North America, and the map turns green. In Europe, the battle is harder fought, but Android generally leads, holding approximately 66% of the market share across the continent. Countries like Germany show strong Android preference with 61% market share. But the real dominance is found in the emerging economic powerhouses of the world. In Asia, Android captures 79% of the market, driven by massive populations in China and India. In India specifically, Android is practically a monopoly, commanding a staggering 95% of the market. Similarly, in South America and Africa, Android holds 84% and 85% market shares respectively. For the vast majority of the planet, “smartphone” is synonymous with “Android.”

The Vendor Battlefield: Samsung and the Challengers

Because Android is an open platform, discussing its success requires looking at the manufacturers who actually build the phones. In 2026, the landscape is competitive, but there is still one clear king of the hill. Samsung continues to be the leading Android vendor worldwide, holding 30.8% of the Android vendor market share. The South Korean giant has successfully navigated the market by offering everything from the entry-level A-series to the premium S-series, ensuring they have a product for every wallet size.

Trailing Samsung is a legion of Chinese manufacturers who have aggressively expanded beyond their home borders. Xiaomi holds the second spot with 15.9% of the market, having successfully wooed budget-conscious consumers in Europe and India with high-spec hardware at competitive prices. They are followed by brands like Vivo (11.2%), Oppo (10.1%), and Realme (5.2%). Interestingly, the fragmentation that used to plague Android is becoming more consolidated among these key players, who are now delivering better software support and longer update cycles than in previous years, helping to retain users who might otherwise switch to iOS.

The App Ecosystem: Quantity vs. Revenue

The statistics surrounding the Google Play Store versus the Apple App Store in 2026 highlight a classic quality versus quantity debate, though the lines are blurring. The Google Play Store is currently home to 2.06 million apps, a vast library that outstrips the App Store in sheer volume. Because publishing on Android is generally more accessible and open, it remains the playground for developers globally to launch their ideas. In terms of downloads, Android crushes the competition simply due to its user base size. Essential social apps drive these numbers, with heavyweights like Instagram garnering over 584 million downloads on the platform recently.

However, a fascinating discrepancy remains in the revenue figures. despite having nearly 70% of the market share, Android lags behind in consumer spending. Data shows that iOS generates significantly more revenue, accounting for roughly 67% of consumer app spending. This indicates that while there are far more Android users, the average Android user is less likely to spend money on in-app purchases or premium subscriptions compared to an iPhone user. This economic reality forces developers to often prioritize iOS for initial releases, although the gap is narrowing as middle-class populations in Android-dominant regions like India and Brazil grow their digital spending power.

Why Android Wins Emerging Markets

Furthermore, the open nature of the Android OS allows for localization and customization that iOS simply does not permit. Local manufacturers in regions like Africa and India can build Android skins tailored to local languages and cultural needs. This flexibility, combined with the ability to sideload apps and share files easily via Bluetooth or direct transfer without proprietary restrictions, makes Android the practical choice for infrastructure-light environments. As the next billion users come online, statistics suggest they will almost certainly be logging in via an Android device.

Android Smartphone Growth and Ecosystem Overview (2010–2026)

The following table displays the annual growth in active Android smartphone users, total Android phones (devices), and the number of Android applications globally from 2010 to 2026.

|

Year |

Active Android Users (Billions) |

Android Phones Sold/Active (Billions)* |

Android Applications (Millions) |

|---|---|---|---|

|

2010 |

0.06 |

0.08 |

0.10 |

|

2011 |

0.23 |

0.28 |

0.18 |

|

2012 |

0.50 |

0.52 |

0.35 |

|

2013 |

0.70 |

0.70 |

0.65 |

|

2014 |

1.00 |

1.01 |

1.30 |

|

2015 |

1.40 |

1.38 |

1.60 |

|

2016 |

1.70 |

1.82 |

2.00 |

|

2017 |

2.00 |

2.11 |

2.20 |

|

2018 |

2.30 |

2.37 |

2.60 |

|

2019 |

2.50 |

2.65 |

2.80 |

|

2020 |

2.80 |

2.99 |

2.87 |

|

2021 |

3.00 |

3.18 |

3.00 |

|

2022 |

3.30 |

3.32 |

2.69 |

|

2023 |

3.50 |

3.46 |

2.67 |

|

2024 |

3.60 |

3.58 |

2.00 |

|

2025 |

3.90 |

3.82 |

2.07 |

|

2026 |

3.90+ |

3.95+ |

2.06 |

Android phones represent global total devices sold or actively in use, which may be slightly higher than the number of active users due to device replacement and multiple device ownership.

Source: Data compiled from Business of Apps, AppMySite, Statista, and 42Matters.

Note: Figures represent estimated end-of-year values and are rounded for clarity.

Conclusion: The Global Operating System

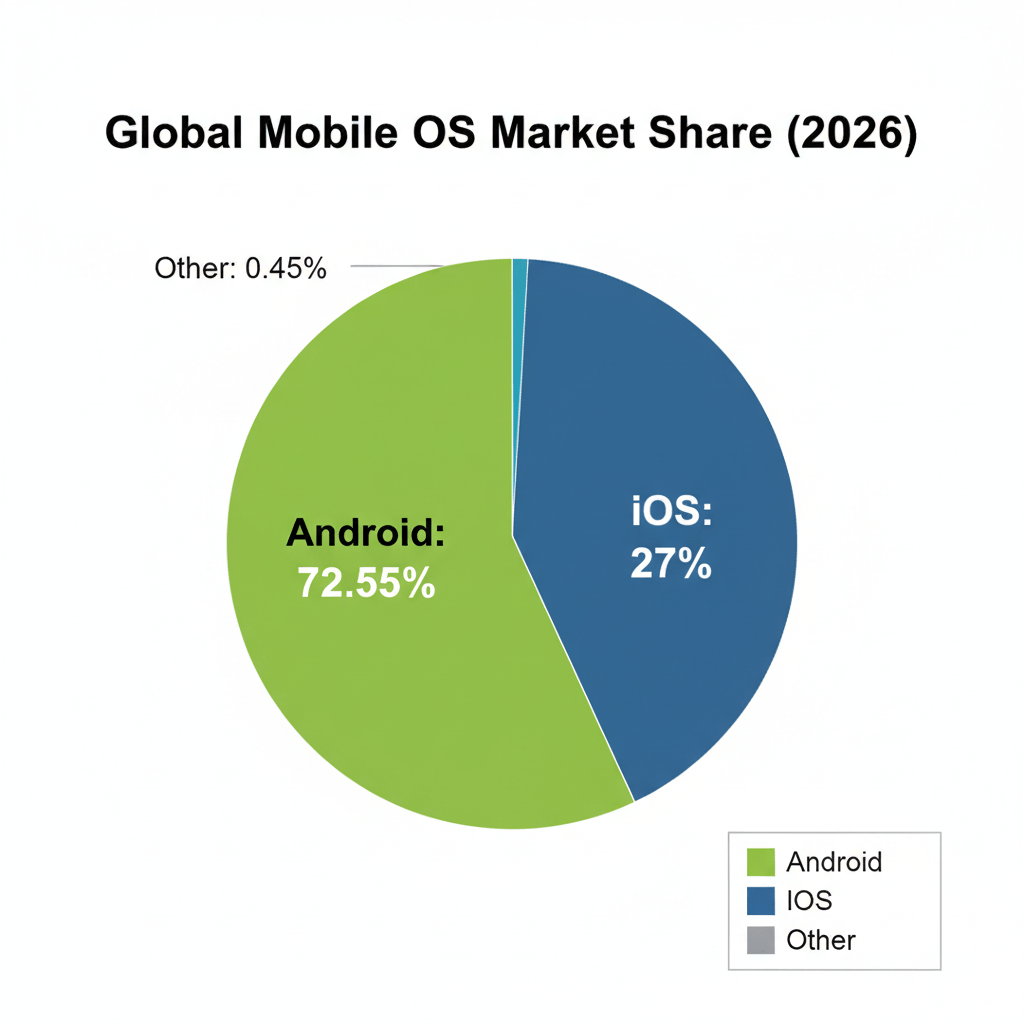

As we analyze the landscape of 2026, the conclusion is undeniable: Android is the operating system of the world. With 3.9 billion users and a market share that hovers above 72%, it is the primary vessel for human digital interaction. While Apple may capture the lion’s share of profits and dominate the cultural conversation in the United States, Android dominates the actual usage metrics of the human population.

From the bustling tech hubs of Bangalore to the cafes of Berlin, Android’s flexibility, affordability, and open ecosystem have cemented its place as the leader. The statistics of 2026 tell a story of a mature, diverse platform that has successfully weathered competition to remain the default choice for the planet. Whether through a high-end Samsung foldable or a budget Xiaomi handset, the green robot is powering our collective digital future.

Frequently Asked Questions (FAQs)

How many people use Android in 2026?

In 2026, the number of active Android users has reached a staggering 3.9 billion people worldwide. This massive user base makes Android the most widely used operating system on the planet, far surpassing any other mobile or desktop platform.

Android currently holds approximately 72.55% of the global mobile operating system market share. This dominance has remained relatively stable over the last few years, showcasing the platform’s stronghold on the international market despite strong competition in specific regions like North America.

Which countries have the highest Android adoption rates?

Android sees its highest adoption rates in emerging markets and heavily populated nations in Asia, South America, and Africa. Specifically, India is a major stronghold where Android holds roughly 95% of the market. Other countries with exceptionally high adoption rates include Brazil, Indonesia, Turkey, and Vietnam, where the OS commands over 85% of the market share.

Who are the top Android vendors?

The market is led by Samsung, which continues to be the top Android vendor with 30.8% of the market share. Following Samsung are several major Chinese manufacturers that drive high volume globally, including Xiaomi (15.9%), Vivo (11.2%), Oppo (10.1%), and Realme (5.2%).

How does Android compare to iOS in terms of app availability?

The Google Play Store generally offers a larger volume of applications compared to the Apple App Store. In 2026, there are approximately 2.06 million apps available on the Google Play Store. While Android has more apps, the Apple App Store typically generates higher revenue from user spending.

Is Android popular in the United States?

While Android is the global leader, it is actually the runner-up in the United States. In the US market, Android holds about 41.71% of the market share, while iOS leads with the majority. This is a unique trend compared to the global average, highlighting a distinct consumer preference for iPhones in the American market.

What is the average price of an Android phone compared to an iPhone?

One of the key drivers of Android’s success is affordability. In 2025/2026, the global average selling price for an Android smartphone is around $293, whereas the average price for an iPhone is significantly higher, often exceeding $1,000. This price gap makes Android the more accessible choice for the majority of the world’s population.